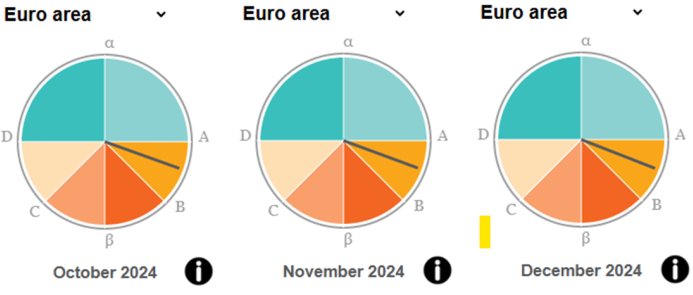

Eurostat’s Business Cycle Clock (BCC) is a tool that illustrates the different phases of the euro area’s economic cycle through a clock-style graph. It represents the empirically observed sequence of turning points in the business, growth, and acceleration cycles. The clock relies on three synthetic indicators: the Growth Cycle Coincident Indicator (GCCI), the Business Cycle Coincident Indicator (BCCI), and the Acceleration Cycle Coincident Indicator (ACCI)—all of which are experimental in nature.

Business Cycle Clock Signals for the Euro Area

According to the latest readings, the euro area economy remains in a slowdown phase, with growth deceleration starting in February 2024.

This slowdown is confirmed by a dating exercise covering up to Q3 2024, which identified the growth cycle peak in Q4 2022. The downturn is largely driven by the industrial sector, while services continue to expand. Economic conditions remain uncertain due to persistent geopolitical tensions, but the absence of recessionary signals is a positive element.

Key Indicators from the Business Cycle Clock

The BCC tool is based on three coincident cyclical indicators:

- Growth Cycle Coincident Indicator (GCCI)

- Business Cycle Coincident Indicator (BCCI)

- Acceleration Cycle Coincident Indicator (ACCI)

Growth Cycle Coincident Indicator (GCCI)

In Q4 2024, the GCCI increased from 0.94 in October to 0.97 in December, signaling that the economy remains in a slowdown phase.

Business Cycle Coincident Indicator (BCCI)

The BCCI remained stable at zero throughout Q4 2024, confirming the absence of recessionary signals.

Acceleration Cycle Coincident Indicator (ACCI)

In Q4 2024, the ACCI rose from 0.95 in October to 0.99 in December, further confirming the ongoing slowdown in economic growth.

The euro area economy continues to navigate a period of uncertainty, but the lack of recession signals provides some optimism for the coming months.

source: EUROSTAT