Economic inequality is a persistent phenomenon that affects millions of people worldwide. It is not only reflected in income but also in consumption capacity, savings rates, and wealth accumulation over time. Understanding these dynamics is key to designing strategies that reduce household financial vulnerability and promote more equitable growth.

Wealth Accumulation and Savings Flows

A household’s wealth is built from savings, meaning the income that is not allocated to consumption. When a household spends more than it earns, it must resort to selling assets or taking on debt to finance itself, which can indicate economic difficulties. On the other hand, a savings rate close to zero means that the household has no margin to face unexpected events or improve its financial situation in the long run.

In the European Union, the median savings rate has increased in recent years, rising from 21% in 2015 to 26% in 2020. However, there are exceptions such as Finland, France, and Romania, where savings capacity has decreased, highlighting the economic fragility of some population sectors.

Inequality in Income, Consumption, and Savings

To measure inequality, the Gini coefficient is used, showing how equitably resources are distributed in a society. While income and consumption coefficients range between 27 and 47 in EU countries, wealth inequality is significantly higher, with values ranging from 46 to 72.

Savings also contribute to inequality: higher-income households have higher savings rates, allowing them to increase their wealth over time. In contrast, lower-income families must allocate most of their earnings to essential goods and services, leaving them unable to save. In countries like Romania, the Netherlands, and Greece, the lowest income quintile shows negative savings rates, indicating severe financial vulnerability.

The Relationship Between Poverty and Consumption

The interaction between income and consumption indicators reveals that some individuals not only have low incomes but also must severely restrict their consumption. In 2020, 24% of the EU population was at risk of poverty due to insufficient income or extremely low consumption levels. In countries such as Spain, Latvia, and Estonia, this figure approached 30%.

Despite this reality, the percentage of households that simultaneously exhibit negative savings rates and low consumption levels is relatively small, around 2.1% in the EU. However, in Romania, this figure rises to 7.5%, while in Spain, it reaches 3.1%.

The Life Cycle of Savings

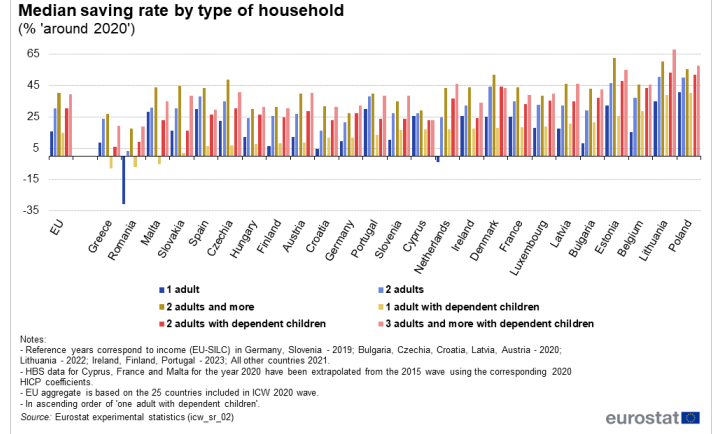

Savings behavior varies according to age and household structure. Young people and retirees tend to have lower savings rates, whereas working-age adults typically save more. Additionally, single-parent households with children face greater difficulties in generating savings, highlighting the need for supportive policies for these groups.

source: EUROSTAT